is acquisition good for stock

An asset sale is the purchase of individual assets and liabilities whereas a stock sale is the purchase of the owners shares of an entity. The Findaway acquisition is good for investors given that audiobooks are growing in popularity among consumers and a greater share of revenue from audiobooks going forward could boost its.

Lee Lee To Finance Acquisition And Refinance Long Term Debt With Berkshire Hathaway At 9 An Stock Trading Strategies Pump And Dump Options Trading Strategies

If the shares of the company being acquired are trading below the price that is to be paid be the acquiring company that difference can wind up in your pocket.

. Stocks with a value score from 0 to 20 are considered deep value those with a score between 21 and 40 are a good value and so on. Evaluating an Acquisition. Diversify your portfolio with guidance from investment professionals.

The GDPR is a data privacy regulation that imposes certain data protection obligations on data controllers ie companies that decide how your information will be used and makes the. Very often acquisitions arise because companies are in the mature phase of their life cycle. But I could see some companies potentially eying them as an acquisition target.

Were thinking long term and doubling down on this stock. A number of deal-related and fundamental attributes can be used to separate the good from the bad and sometimes the really ugly. During an acquisition there is a short-term impact on the stock prices of both companies.

Intels current and future presence in the US Asia and Europe signifies that it should play a key role in the semiconductor supply chain. 9 hours agoThe stock trades at 13x FY24E PE which is attractive considering Angel Ones strong earnings growth profile The brokerage firm has maintained a buy rating on the stock premised on 20x FY24E EPS. The classification of stock acquisitions into OV and NOV groups is described in Table 3.

23 hours agoThis was 127 billion implied enterprise value for Zynga. For the acquirer the main benefit of paying with stock is that it preserves cash. Danny Vena owns Block Inc Netflix PayPal Holdings Peloton Interactive Roku and SoFi Technologies Inc.

PROVIDED That the deal is consummated that. As good as they may be at what they do theres no way for them to. One of the primary benefits of engaging in an acquisition based growth strategy is an improved cost structure.

The second measure of acquisition premium AP 2 is estimated for stock-swap acquisitions only. Avanti Acquisition Corp has a Value Score of 43 which is Average. Ad Worried about the market.

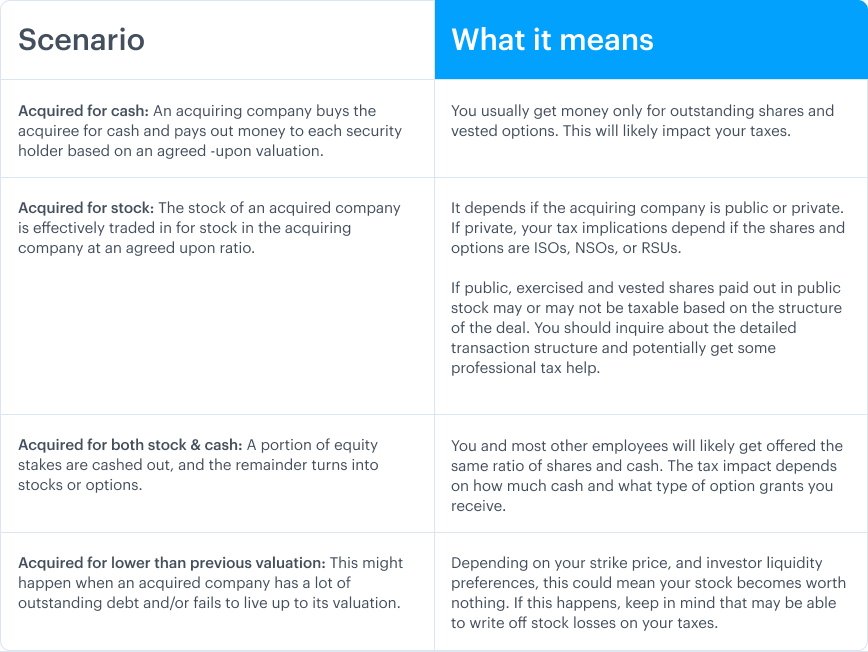

The first step in evaluating an acquisition candidate is determining whether the asking price is reasonable. The second measure of acquisition premium AP 2 is estimated for stock-swap acquisitions only and is the exchange ratio divided by the relative stock price of the target and bidder 42 trading day before the announcement. Its important to consider which side of the MA deal your stock falls in.

Acquisitions are good if you want to improve the cost structure of your business. Answer 1 of 3. When buying or selling a business the owners and investors have a choice.

Many other factors such as the companys structure and the industry can also influence the. It was around 350 a share in cash stock worth about a little over 6 a share of Take-Two stock. Is a blank check company.

To be assigned a value score stocks must have a valid non-null ratio and corresponding ranking for at least two of the six valuation ratios. For the seller a stock deal makes it possible to share in the future growth of the business and enables the seller to potentially defer the. For buyers without a lot of cash on hand paying with acquirer stock avoids the need to borrow in order to fund the deal.

Stick With The Fundamentals. Typically the target companys stock rises while the acquiring companys stock falls. Asset Purchase vs Stock Purchase.

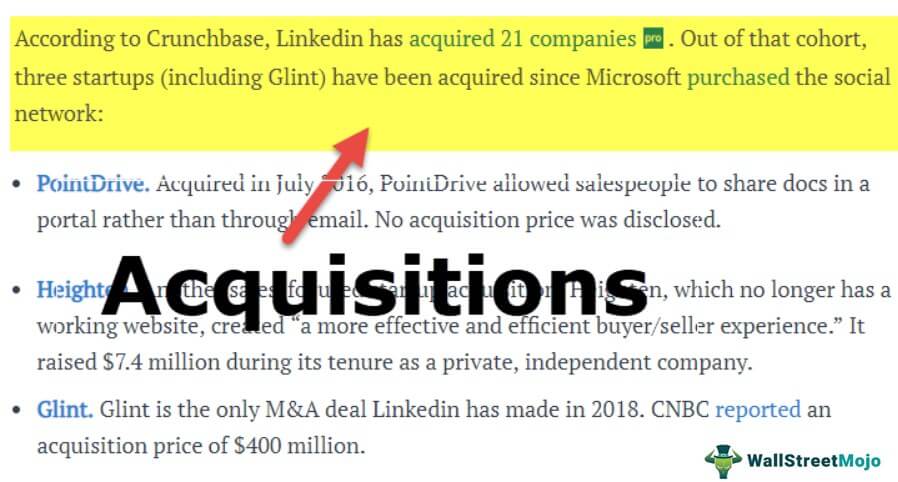

Capture profits with Cabots current top stock picks. The deal structure of any transaction can have a major impact on the future for both the buyer and seller. For LinkedIn shareholders the Microsoft deal was an all-cash acquisition meaning shareholders received 196 cash for each share of LinkedIn they held.

Digital World Acquisition Corp. If you own stock in a company thats being acquired I. How this fund beats the SP in bull and bear markets.

The last two columns report the. Answer 1 of 3. The transaction can be a purchase and sale of assets or a purchase and sale of common stock.

Ad How this fund has thrived as the market tanked. Answer 1 of 6. One of the reasons and there may be others such as tax structuring in certain jurisdictions is that with a stock acquisition the buyer buys not only the assets owned by the company which are generally visible or at least known.

Typically the target companys stock rises while the acquiring companys stock falls. Market advice from proven experts. This is risk arbitrage.

Ad Top stock tips and picks from a trusted source since 1970. The LinkedIn buyout officially closed this. The Tower acquisition together with a.

During an acquisition there is a short-term impact on the stock prices of both companies. This was a 64 premium to what Zyngas. Expand Talent Sometimes an acquisition can be attractive because of the people it brings with it such as technology innovators or an exceptional sales team or seasoned executives.

In this study we show that among Russell 3000 firms with acquisitions greater than 5 of acquirer enterprise value post-MA acquirer returns have underperformed peers in general. It intends to effect a merger capital stock exchange asset acquisition stock purchase reorganization or related business combination. Get your free report today.

A good acquisition target has clean organized financial statements. The metrics investors use to place a value on an acquisition. The buyer of the assets or stock the Acquirer and the seller of the business the Target can have various reasons for preferring one type of sale over the other.

Diversification effectively states that a diversified portfolio of stocks lowers risk while increasing return when. Most companies follow this cycle. Defensive Positioning You may acquire a company simply to prevent a competitor from owning it so that you can protect your current and future market position.

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

Avoid Value Traps With One Simple Scoring System Scoring System Positive Cash Flow Value Investing

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

Microsoft The Biggest Acquisition Value Investing Investing Good Student

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

Mergers Acquisitions Solutions Bahrain And Uae Merger Business Valuation Solutions

The Stock Market Is Never Obvious It Is Designed To Fool Most Of The People Most Of The Time Jesse Livermore Stock Market Quotes Marketing

What Happens To Equity When A Company Is Acquired Carta

Acquisition Meaning Examples Benefits How It Works

Cash Vs Stock Acquisitions M A Payment Consideration

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

Why Ibio Stock Is A Speculative Bet That Can Double Growth Nfl Season Stitch Fix

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

Stock Catalyst Verkrijgen Economical Vrijheid Kan Een Doel Voor Meerdere Financieel Vrijhei Finance Investing Finance Infographic Money Financial

What Are Spacs And Should You Invest In Them Money For The Rest Of Us

Talent Acquisition Services Stock Illustration Illustration Of Human Five 155602545 Talent Acquisition Talent Stock Illustration

Mergers And Acquisitions M A Planning And Successful Ipo Mergers Acquisitions M A Planning Ipo Consulting How To Plan Succession Planning Management

5 Primary Elements Regarding Small Business Acquisition Loan 1million Business Ideas In 2022 Small Business Business Part Time Business Ideas