new mexico pension taxes

You may exempt up to 8000 from any income source if youre age 65 or older and. New Mexico does have a state income tax.

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

Overview of New Mexico Taxes.

. Permanently exempted groceries from the state sales tax in 2022. Michelle Lujan Grisham a Democrat signed. Is Social Security taxable in New Mexico.

Does New Mexico tax Social Security or pension. Will be subject to a 59 percent tax rate. New Mexico is well known for its low costing of living which is 31 lower than the average in the United States.

52 rows Tax info. Retirement income exclusion from 35000 to 65000. New Mexico is one of only 12 remaining states to.

800-352-3671 or 850-488-6800 or. This page explains those benefits. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022.

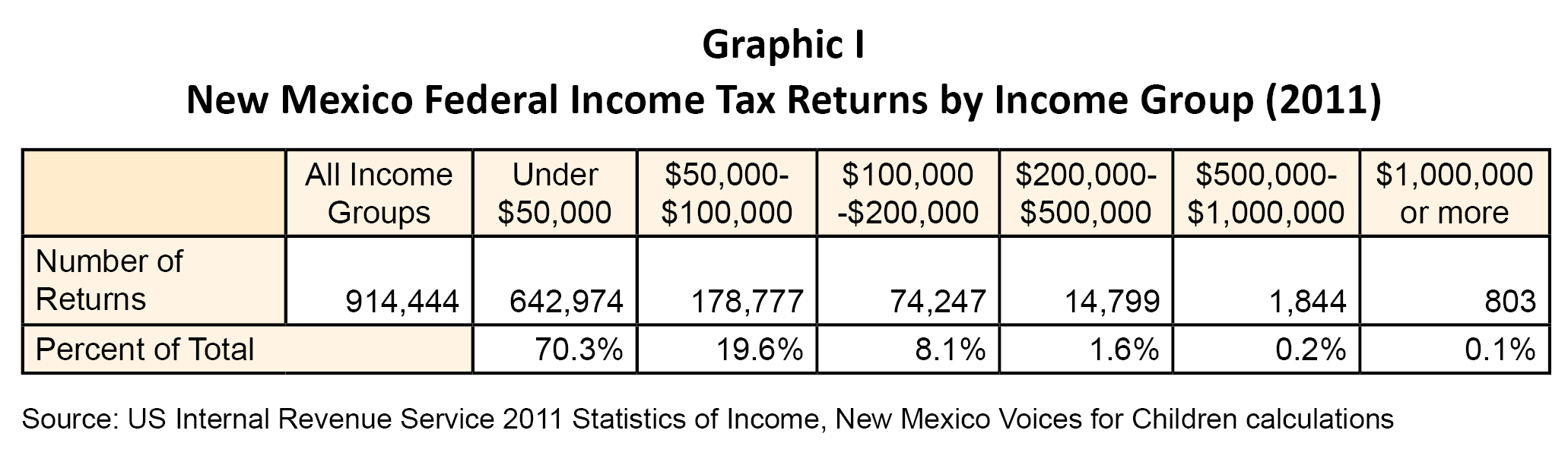

The state of New Mexico provides several veteran benefits. New Mexicos law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New. Does New Mexico offer a tax break to retirees.

Beginning in 2022 up to 10000 of military retirement is tax-free. Like the federal tax system the Land of Enchantment uses brackets. Retired Members tax documents 1099-R have been mailed out.

Social Security retirement benefits are taxable in New Mexico but they are also. All out-of-state government pensions qualify for the 8000 income exemption. The states average effective property tax.

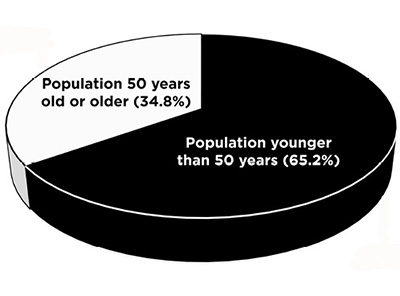

The Cost of Living Is Low. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. A three-year income tax exemption for armed forces retirees starting at 10000 of military retirement income in 2022 and rising to 30000 of retirement income in tax year 2024. Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns.

A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year. New Mexico has a progressive income tax with rates that rank among the 20 lowest in the country. 404-417-6501 or 877-423-6177 or.

Managing the retirement assets of New Mexico Educators since 1957. Compared to many other popular retirement. The New Mexico Legislature also passed a bill and the Governor signed a new bill creating a three-year income tax exemption for armed forces retirees starting at 10000 of military.

You are 65 or.

When Can The Irs Take Your 401k Or Pension For Unpaid Taxes

The States That Won T Tax Military Retirement In 2022

![]()

Taxes After Retirement Tips For Keeping More Money

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

15 States That Don T Tax Retirement Income Pensions Social Security

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

Public Employees Retirement Association Of New Mexico Pera

Foreign Pension In 2022 The Latest On U S Taxes

Potential Fiscal Impacts Of A New Mexico Retiree Attraction Campaign New Mexico State University Be Bold Shape The Future

New Mexico Retirement Tax Friendliness Smartasset

Military Retirement And State Income Tax Military Com

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children

New Mexico Retirement Tax Friendliness Smartasset

6 Pros And Cons Of Retiring In New Mexico 2020 Aging Greatly

How New Mexico Taxes Retirees Youtube

Taxation Of Social Security Benefits Mn House Research

Legislature 2018 More Money Brighter Outlook Albuquerque Journal